top of page

All Posts

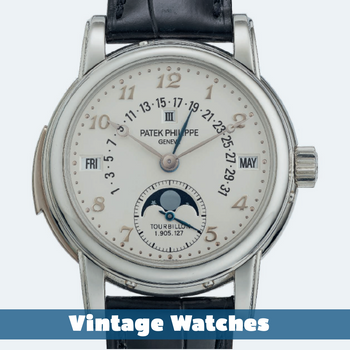

#6 Wulf Schütz - Vintage Watches

Wulf Schütz explains how vintage watches have become a stable and rewarding asset class. He shares how rarity, provenance, and condition influence value and why proper due diligence and trusted sources are key to avoiding costly mistakes in the high-end watch market.

Dec 16, 2019

#5 The 2nd instalment of my interview with Bill O’Neill, Head of the Investment Committee of a London multi-family office.

Bill O’Neill shares how strategic asset allocation drives investment outcomes, why derivatives require caution, and how alternatives reshape modern portfolios. He also explains how staying humble and filtering signal from noise can lead to better decisions in an increasingly complex market environment.

Dec 9, 2019

#4 Bill O'Neill - Head of the Investment Committee of a London multi-family office

Bill O’Neill explains how to design an investment portfolio that aligns with your goals, risk tolerance, and time horizon. He explores the role of diversification, why asset allocation matters more than stock picking, and how to assess real risk beyond volatility using practical client examples.

Nov 29, 2019

#3 Athan Tolis - Founder and CEO of Actium Liquidity Partners / Algorithmic Bond Research

Athan Tolis explains how bond markets really work, why central banks have quietly delivered for asset owners, and where investors can still find alpha despite low yields and poor credit market liquidity. A candid conversation on bonds, interest rates, active vs passive investing, and why Trading Places tops his movie list.

Nov 9, 2019

#2 Jürgen Michels - Chief Economist Bayerische Landesbank

Economist Jürgen Michels explains how to navigate economic noise, why German views on inflation differ from Anglo-American ones, and how tax systems may shift from labor to data in the future as Europe grapples with digital economies and unified fiscal policies.

Sep 21, 2019

#1 Toby Hayes -Alternative Beta

Toby Hayes breaks down the concept of structural risk premia and how these strategies offer returns that are independent of market cycles, central bank moves, and investor sentiment. He explains how simplicity, clear signals, and a deep understanding of underlying markets help avoid crowded trades and backtest bias.

Jun 24, 2019

bottom of page